Insurance means a form of risk management primarily hedged against the risk of contingent, or uncertain. People take insurance to protect them and their family, if something unexpected happens to the individual who is getting insured. There are so many Insurance companies across the world, who works on polling system, where they try to insure their customer in exchange to regular payments, and they will pay one-time payment or partial payments as per the Insurance Policy.

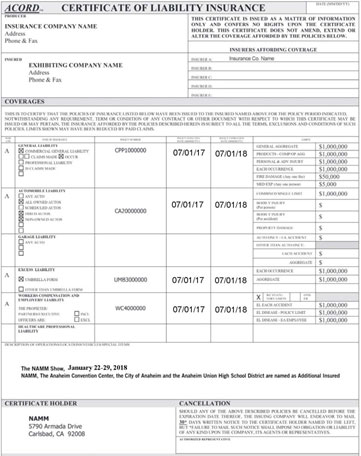

Documents are necessary to evidence the existence of a contract. In life insurance several documents are in vogue. The documents stand as a proof of the contract between the insurer and the insured. The major documents in vogue in life insurance are premium receipt, insurance policy, endorsements etc.

The idea find explaining about Insurance Workflow was to make you understand, that the documents provided by the Insurance Company are very valuable and precious for the Insured Individual as he is doing risk management for the future. So, it is essential for the Insurance Provider to provide a high standard of security in their documents which they provide to their customers. That’s where, Secure Docs comes into picture; it is necessary for the Insurance Service Provider to safeguard its document with the help of Secure Docs layered-security approach, which will make it anti-theft, anti-counterfeit, anti-alteration, anti-forgery with overt and covert security features.

Due to rapid growth in the educated population of the world, people have started understanding the importance of risk management; so they have started taking Insurance for them and their family, so as the members of the Insurance industry are increasing so does the amount of documents, so it is essential for every Insurance company to get Secure Docs to safeguard their documents and reputation. Secure Docs can be used in Insurance Sector for: